When it comes to valuing a currency or simply “money”, there are several factors to consider, such as Demand & Supply of a particular currency in the market, consider a higher demand for a currency in trade and tourism causes an appreciation in the currency or an increase in supply of currency by “Money printing” causes a depreciation of the currency.

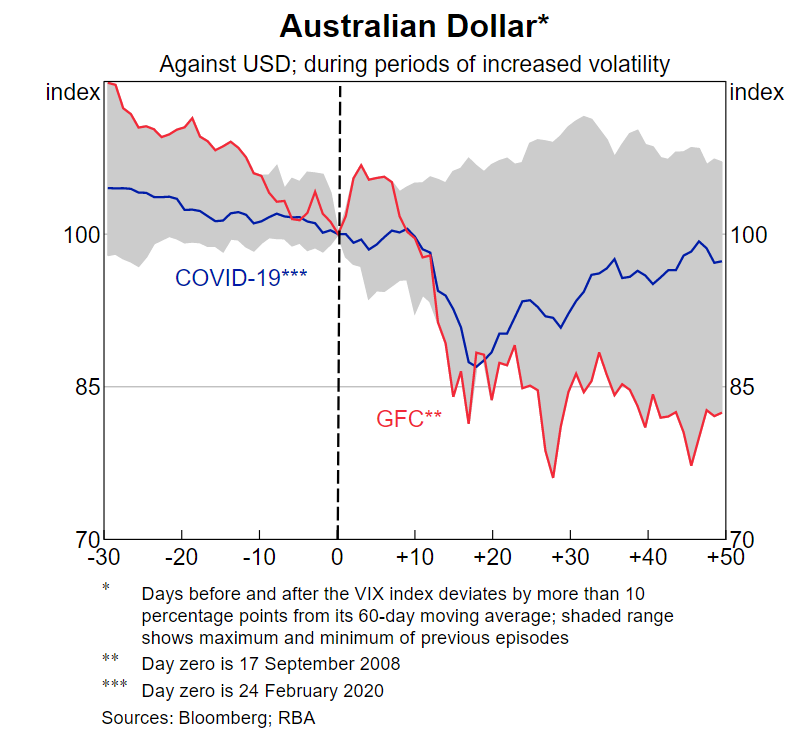

Since the Australia’s border has been closed for several months, we observe the decline in Australian dollar relative to the US dollar for the past few months:

Furthermore, a currency’s inherent value can be determined by its purchasing power, convertibility, and stability. The purchasing power of a currency is determined by the amount of goods or services that one unit of that currency can purchase, whereas convertibility refers to the ease with which a particular type of money may be turned into other currencies or commodities such as gold or silver. Stability is defined as firms and consumers’ ability to rely on the market economy.

Australia’s economy has expanded consistently over the past 29 years without experiencing a recession (referring to my article Australia Economy Past Present and Future). This is a remarkable achievement by a developed economy with a small population of only 25 million people.

The Australian dollar is the currency of Australia, officially known as the dollar and symbolized by A$ or AU$ and is subdivided into 100 cents. It is also widely used as a reserve currency after the United States dollar and is frequently traded internationally on foreign exchange markets. Australia introduced the Australian dollar in 1966 to replace the Australian pound, which had been in circulation since 1910.

AUD-USD and AUD-HKD are both trading higher than the expected inflation rate. The consumer price index showed that the annual rate of inflation rose to 2.1% for the first quarter of 2018, above economists’ expectations of 1.9%. The Australian dollar is worth more than ever, as the price of gold continues to rise. The Australian dollar has made a record high against the US dollar and experts believe it will continue to climb as investors seek safe-haven assets like gold and the Australian dollar. Australia has the world’s largest gold mine and the world’s largest producer of gold, with around 50% of output coming from New South Wales.

Refer to the map above produced by the World Gold Council. It highlights the number of Gold mines currently active around the world. We see that the darker the gold color, the more gold mines that are active in that region/area. Globally, the largest and most active gold mines are in the Asia-Pacific region, particularly in regions of Australia, China and Russia.

According to the Triennial Central Bank Survey by the Bank of International Settlements, the Australian dollar is the fifth most traded currency in the world, making up approximately 7% of total daily trades compared with 88% for the USD. The Australian dollar is popular with traders because of its stable political environment and its consistent economic growth over many years. Australia has maintained its credit rating with a triple AAA rating (score 100 points) by S & P, compared to Hong Kong’s credit rating of AA+ (score 90 points).

Fiat Currency vs Gold Standard

A gold standard monetary system is one in which the standard economic unit of account is denominated in gold. Typically, traders in such a system will convert paper currency at a set rate to the underlying precious metal. Gold is classified into three different forms: specie, bullion, and exchange. A coin is a little piece of metal having a monetary value stamped on it by the government. Bullion is a term that refers to pure gold bars. The term “exchange” refers to the market activity of buying and selling gold.

In fact, we can only assert that gold has been used as money for thousands of years, as evidenced by the Egyptians, the Roman Empire, and the Chinese civilizations, among others. However, more recently, in 1945, following the devastation of WWII and the lessons learnt from the German hyperinflation crisis during WWI, the Bretton Woods Agreement established a new gold standard. This was a critical accord not only for renewing trade between countries, but also for global trade stability, which was predicated on trust in the USD being supported by a gold standard.

The Australian gold standard was the first attempted use of a gold standard in the history of the Commonwealth of Australia. It was introduced with the passing of the Gold Standard Act on September 28, 1903 by the Fisher Labor government. It lasted until February 14, 1931, when it was effectively repealed by Prime Minister Joseph Lyons, despite both major political parties having campaigned against its abolition in the 1929 election. It was not technically a true gold standard system at its introduction because Britain retained some control over Australian monetary policy.

However, in 1973, US President Nixon broke the gold standard due to the US being unable to pay its expenses in the Vietnam War and essentially abusing its role as the reserve currency. Thus, the Bretton Woods agreement came to an end.

The Bretton Woods Agreement was signed in New Hampshire, the USA on 22nd July 1944. It was established by 44 countries for the restoration of the international monetary order after the conclusion of World War II. It took place in New Hampshire; hence its name Bretton Woods. The agreement set out a new system of rules and regulations which were aimed at addressing the problems arising from the Great Depression and to help prevent such economic disasters.

Following the end of World War II, the international monetary system was in disarray. The Bretton Woods Agreement—signed by 44 nations—had established a gold standard for international trade. But by 1970, Free Trade Agreements had been signed with over 60 countries, and the United States was running a trade deficit. These issues were exacerbated by President Nixon’s campaign promise to end wage and price controls.

Hyperinflation Crisis

As you can see in the graph on the inflation rate of United States of America. This is a recent data released by the US government, just in month of October 2021. US inflation has reached a new record of 31 year high.

This is becoming very concerning, inflation should not surpass on average 2-3% per annum. However, in the US inflation has grown to above 4-5% in the past 4 months.

In 1971, known as the “Nixon Shock”, US president Nixon broke the gold standard in the USD, making all currencies known as “Fiat Currency”. President Richard M. Nixon decided to shift the nation’s foreign policy emphasis from containment of communism to a more pro-active stance. In what came to be known as his New Economic Policy (NEP), which included wage and price controls, import quotas, and tax reforms, he sought to create an environment conducive to business expansion and recovery.

Gold, Real Estate and “Paper Money”

In a recent Bloomberg interview with the #1 all time New York Times best seller Robert Kiyosaki in 2020. The interviewer has asked Robert on how he sees money and what does wealth means to him. Robert explains this in 3 layers of wealth pyramid:

- Ownership of Tangible/Physical Gold, this most important layer of all. This represents the foundation of your money.

- Ownership of both Land and Houses, the 2nd layer is also important as this provides you with both regular income, appreciation, tax benefits and land ownership.

- The final Top layer is the rest of other so called “paper money” investments e.g., stocks, bonds, paper currency, etc

Surprisingly, Australia has both of the most important foundations of wealth as explained by Robert. Australia has physical gold ownership (largest gold mine in world) and a surplus supply of land to build and for 100% foreign ownership. Therefore, when we invest in Australia, we can have build a solid foundation of wealth and not only “paper money”. Investing in AUD, we can benefit from the stability of Australian economy as well as physical ownership of assets that you would not be able to in other countries such as Hong Kong!

It is always a good idea to keep track of the currency exchange rate between Australia and Hong Kong because the fluctuations can offer you an opportunity to invest, and at the right time, you can make huge returns with the same amount of money. (Please refer to my article on upcoming changes to central bank interest rates and projection of AUD exchange rate)

Finally, we should not look at money simply as a number, but more towards how money can be a “store of value” for the future. If we are excessively printing money globally and inflation keeps rising in future, we will see a big distortion between market price and the actual intrinsic value of assets. Gold has proven historically a great store of value asset overtime regardless of any financial crisis or breakout of wars, in fact Gold rises when more uncertainties arises!

To learn more about currency exchange and keeping your money afloat and be ahead of any upcoming financial crisis.

Contact me now at [email protected] and book a 1 to 1 consultation!

Sources:

https://www.investopedia.com/terms/b/brettonwoodsagreement.asp

https://tradingeconomics.com/australia/rating

https://history.state.gov/milestones/1969-1976/nixon-shock

https://www.gold-eagle.com/article/%E2%80%9Cgold-god%E2%80%99s-money%E2%80%9D-%E2%80%93-%E2%80%98rich-dad%E2%80%99-bloomberg-tv

https://www.rba.gov.au/publications/smp/2020/may/box-b-recent-developments-in-foreign-exchange-markets.html

https://www.bis.org/statistics/rpfx19_fx.pdf

Neither the authors nor the publisher can guarantee the accuracy of the information contained herein. The authors and publisher specifically disclaim any responsibility for any liability, loss, or risk, professional or otherwise, which is incurred as a consequence, directly or indirectly, of the use and application of any of the contents of this article.